What’s the Best Type of Crowdfunding Platform to Serve a College or University Entrepreneurship Center, Co-Working Space, Incubator or Accelerator Program?

Understanding the Crowdfunding Funding Process

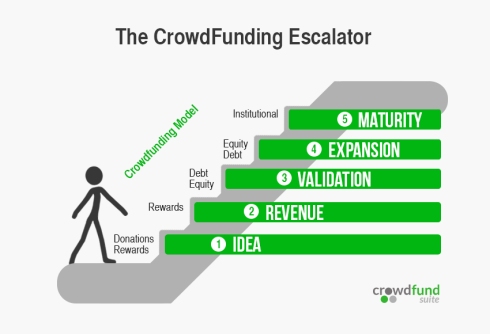

The first step in building a crowdfunding business model is to understand the various forms of crowdfunding and at what step of the business creation process each should be used.

This crowdfunding infographic is a good representation on each step of the business creation process from the business idea, generating revenue, validating marketplace demand, expanding operations and maturing into a fortune 500 company. It also shows what type of crowdfunding is usually best to fund startups and each step of the business’ evolution.

Source: CrowdfundSuite.com

Donation-based Crowdfunding – At kitchen tables, dinner parties, happy hours and dorm rooms around the world many brilliant ideas are born and discussed for the very first time. Once an idea has been pitched and vetted among friends and family and it begins to gain momentum toward the first step of crowdfunding, Donation-based Crowdfunding, which is used to scrape enough money together to begin building a business plan to figure out how much it will cost to bring a business idea to fruition and/or develop at one or more prototypes. Donation crowdfunding sites make it easy to collect money for new creative ideas as well as expand the crowdfunding campaign’s reach from just family and friends to a global audience of potential supporters.

Most donation-based crowdfunding sites are usually built to provide fundraising activities for campaigns that do not offer any rewards or perks. They are also used to support non-profit causes. Donations to 501(3)(c) are tax deductible and can be written off at the end of the year.

Most universities will only build donation-based crowdfunding sites that can be used by students and faculty to collect money by students and faculty for a wide variety of projects including college educations, scholarships, research and development, campus improvements and all kinds of not-for-profit endeavors. Crowdfunding can be used for very small fundraising efforts to raising millions of dollars from alumni, foundations, institutional investors and corporate sponsors.

Donation-based crowdfunding sites will make it easy for anyone to search for, discover, research and fund their favorite pet projects on their alma mater’s campus.

Rewards-based Crowdfunding – Surprisingly enough 90% of people in the world still are not familiar with the term crowdfunding. Mention Kickstarter or IndieGoGo and most people do recognize the brand name and know its purpose and have heard of popular crowdfunding campaigns such as Oculus, Star Citizen, Coolest Cooler and the return of the Pebble Time SmartWatch.

Rewards-based campaigns are used to take ideas, concepts and prototypes to the next level. They are used in a similar fashion to how typical marketing campaigns are used to support product/service launches and rollouts with an added twist.

People with ideas build a crowdfunding profile, shoot a crowdfunding pitch video and build a list of up to 20 perks or rewards that are pre-sold to raise enough money to develop a prototype or pay for the very first manufacturing production run. Not only do rewards-based crowdfunding campaigns validate industry demand, but they allow businesses to test market various product versions, colors and price points to gauge public interest. More importantly, they help startups generate their first revenue by pre-selling their products and services in order to raise enough money to get the business started. Gaining this type of market traction is very important to angel investors because it shows that there is an audience of people who are willing to pay for the company’s products and services.

The best way for universities and colleges to cut their teeth on the crowdfunding business model is to launch a rewards-based crowdfunding site, which usually collects a 5% commission on the crowdfunding campaign’s total amount raised. That may not sound like much but since 2009, Kickstarter alone has raised $1.6 billion, which at 5% means $80 million over 5 years in gross revenue or an average of $16 million per year that could be used to fund a wide variety of college/university projects.

Not only are crowdfunding platforms a good source of revenue, but with the right marketing resources crowdfunding campaigns have the potential to raise a huge amount of marketplace awareness for the university’s projects, business development goals, research and development labs and technology transfer programs. All at no cost to the university because the crowdfunding campaign managers are the ones that spend money to market their crowdfunding campaign to the world.

The other reason to consider launching a rewards-based crowdfunding program is that they are easy and do not fall under the jurisdiction of the SEC or state securities board regulators because no securities are being sold. For new startups it also means that raising money does not involve selling any equity shares or giving up any control of the company’s administration.

Rewards-based crowdfunding campaign commissions can also be used by colleges/universities to establish co-working spaces and to fund college incubator and accelerator programs. Co-working spaces with at least 25,000 sq. ft. can generate millions of dollars per year in additional revenue from rent and mentorship programs.

It is important to note that rewards-based commissions combined with co-working space revenue can provide millions of dollars in seed investment capital to begin funding the next step in the process, equity-based crowdfunding sites, where schools, students, faculty and alumni can become equity investors in new startups.

Equity-based Crowdfunding – Setting up equity-based crowdfunding websites will allow schools to play the role usually enjoyed by Angel Investors, Venture Capitalists and/or Broker-Dealers. They will allow students to raise money for startups by selling debt, such as convertible notes, or selling equity shares for a certain percentage of the company to raise enough seed investment capital to produce prototypes, fund early manufacturing runs, setup distribution agreements and hire manufacturer representatives.

Other types of equity crowdfunding involve sharing 20% of the gross profits with investors or making royalty payments on a per item sold basis until the investors receive a 3x to 5x payback on their initial investment.

Investing in startups is a risky business, but with the right education and building a small group of experienced Super Angel investors to follow, a large group of novice accredited investors can invest smaller amounts of money along side seasoned experts with a proven 25-30 year track record.

In states like Texas, Michigan, Georgia and 11 others non-accredited investors can also pool their money together to purchase equity shares of stock. This is something that has been illegal for the past 80 years, but intrastate crowdfunding exemption laws are now allowing average people to begin investing in startups just like angel investors and venture capitalists.

The aggregation of novice accredited and non-accredited investors are known as Investment Syndicates, which is the process of following expert investors. This allows students, faculty members and the general public to learn the equity investment business and enjoy the benefits of being an insider when a great business idea is transformed from a startup company to an Initial Public Offering (IPO).

For example, a $300 investment for a single share of stock and pair of Oculus virtual reality goggles would have paid investors a return on investment of $45,000 when Facebook bought the company for $2 billion dollars.

Equity-based crowdfunding is much more complicated than rewards-based crowdfunding due to the stringent requirements needed to meet the SEC and state securities board regulatory requirements.

Unlike rewards-based crowdfunding, equity crowdfunding provides a great opportunity for business administration, legal and finance students to get hands-on experience writing business plans, structuring deals, protecting intellectual property (IP) and planning real world product/service launches that are part of every single equity crowdfunding campaign.

Working alongside experienced angel investors and venture capitalists is also a great way for students and faculty to learn the finance industry from the inside out.

Learn more about crowdfunding:

- Building a Rewards-based and/or Equity-based Crowdfunding Ecosystem;

- Providing Easy Access to Seed Investment Capital with Crowdfunding;

- Generating More Revenue to Support Co-Working Spaces and Startups;

- Using Equity Crowdfunding Sites to Finance Incubators and Accelerators;

- Taking Advantage of Investor Syndicates that are Seeking Better Deal Flow;

- Splitting Revenue from Incubator and Accelerator Mentors Consulting Fees;

- Streamlining Technology Transfer Offices (TTOs);

- Cross-Pollinating College Education with Real World Startups; and

- Learning to Build Better Alumni and Local Community Relationships

# # #

Want to learn more about crowdfunding campaigns or how to setup a crowdfunding platform?

Please fill out this form to get started:

You must be logged in to post a comment.